A

weekly

message

from

your

Senator

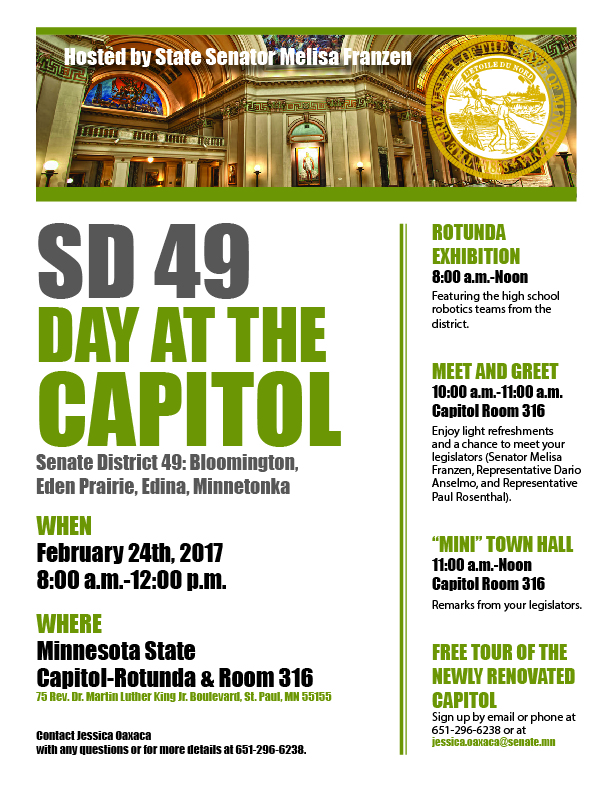

I

am excited

to

announce

that

we

are

hosting

a

Senate

District

49

Day

at

the

Capitol

on

Friday,

February

24th.

We

plan

to

offer

tours

of

the

newly

renovated

Capitol,

have

a

“mini”

town

hall

to

meet

with

constituents

and

showcase

some

of

our

districts

most

impressive

high

school

robotics

teams.

More

details

can

be

found

below.

Recently,

I

have

been

contacted

by

constituents

to

learn

about

my

position

of

several

bills

introduced

dealing

with

demonstrations

in

Minnesota.

I

am

currently

opposed

to

these

“protest”

bills

as

they

are

currently

drafted

as

they

pose

serious

constitutional

questions

regarding

the

right

to

free

speech

among

other

considerations.

Public

safety

of

every

Minnesotan

is

my

top

priority

as

a

member

of

the

Senate

Public

Safety

Committee

and

I

will

evaluate

each

bill

on

its

merits

before

I

cast

my

final

vote.

As

always,

I

appreciate

your

comments

and

concerns.

Feel

free

to

reach

out

anytime

and

I

hope

to

see

some

of

you

on

February

24th

during

SD49

Day

at

the

Capitol.

Sincerely,

Senator

Melisa

Franzen

Senator

Franzen

Hosting

a

Senate

District

49

Day

at

the

Capitol

Governor

Dayton

presents

tax

plan

to

Senate

Tax

Committee

This

week,

the

Senate

Tax

Committee

heard

an

outline

of

the

Governor's

plan

for

the

2018-2019

budget

cycle

(S.F.

726),

which

features

increased

tax

relief

for

many

Minnesotans.

One

form

of

this

tax

relief

is

the

Governor's

proposed

expansion

to

the

Working

Family

Tax

Credit

and

the

Child

and

Dependent

Care

Credit,

which

would

increase

the

benefits

and

allow

a

wider

proportion

of

the

population

to

claim

this

credit

which

aims

to

help

those

who

are

struggling

to

pay

for

costs

related

to

raising

a

child,

including

childcare

and

education

expenses.

The

bill

also

includes

relief

for

the

state's

farmers

and

local

governments

in

an

effort

to

help

alleviate

the

costs

associated

with

the

implementation

of

new

buffer

requirements. The

testifiers on

this

bill,

who

were

from

various

associations

and

nonprofits

from

across

the

state,

were

mostly

in

support

of

the

increased

benefits

to

middle

and

lower

income

Minnesotans.

REAL

ID

Moves

to

Committee

on

State

Government

Finance

and

Policy

and

Elections

The

Senate

Judiciary

Committee

worked

into

this

evening

hours

on

Wednesday

to

vote

on

the

REAL

ID

measure

currently

moving

its

way

to

the

Senate

floor.

The

bill

is

attempting

to

compromise

federal

rules

for

official

forms

of

identification

and

Minnesota’s

own

rules

regarding

such

documents.

It

has

been

an

unresolved

issue

over

the

past

few

years

as

language

in

previous

bills

was

restrictive

towards

immigrants

and

gave

the

federal

government

some

power

over

Minnesota’s

licensing

practices.

What

is

currently

being

proposed

is

a

two-tiered

system

of

licenses

with

the

first

tier

being

a

federally-compliant

ID

and

the

second-tier

being

a

Minnesota-compliant

ID.

The

federally-compliant

ID

would

be

usable in

all

domestic

flights

and

travels,

whereas

the

Minnesota-compliant

ID

would

require

less

personal

information

and

may

not

be

accepted

as

a

form

of

identification

in

some

airports.

Minnesota

has

until

January

2018

to

figure

out

a

course

of

action.

The

bill

narrowly

passed

with

a

4-3

vote

and

is

on

its

way

now

to

the

Committee

on

State

Government

Finance

and

Policy

and

Elections

(S.F.

166).

Preemption

Bill

moves

to

committee

S.F.

580

was

heard

this

week

by

the

Jobs

and

Economic

Growth

Finance

and

Policy

Committee,

which

would

prevent

local

governments

from

creating

their

own

labor

practices,

including

wage

and

certain

work-related

benefits,

if

not

compliant

with

statewide

standards.

Testifiers

included

organizations

such

as

the

Minnesota

Chamber

of

Commerce,

who

showed

support

for

the

bill,

as

they

feel

there

could

be

inconsistencies

in

labor

practices

across

the

state

if

local

governments

are

allowed

to

dictate

their

own.

Those

in

opposition

to

the

bill

included

many

labor

organizations

that

argued

that

cities

should

be

able

to

decide

what

is

best

for

their

local

constituents,

as

they

are

closer

to

them

and

better

understand

what

benefits

the

workers

in

their

areas

the

most.

This

year,

many

Minneapolis

and

St.

Paul

residents

are

going

to

receive

the

newly-enacted

increased

paid

leave

benefits,

which

mirror

similar

proposals

in

31

other

cities

across

the

country.

This

proposal

is

in

large

part

in

reaction

to

that

ordinance.

The

bill

passed

the

Jobs

and

Economic

Growth

Finance

and

Policy

Committee

and

was

referred

to

the

Local

Government

Committee.

Controversial

Anti-Protesting

bills

introduced

in

Senate

Three

bills,

S.F.

679,

676,

and

148,

have

been

introduced

in

the

Senate

mirroring

bills

already

proposed

in

the

House.

These

bills

are

an

effort

to

increase

criminal

penalties

and

potentially

make

protesters

liable

for

the

costs

that

may

be

incurred

due

to

public

safety

response.

Supporters

of

the

bill

feel

that

the

stricter

policies

surrounding

protests

are

necessary

due

to

the

increased

disruption,

especially

transportation-related

delays,

that

have

been

associated

with

recent

protests.

Authors

of

these

bills

hope

to

incentivize

future

protesters

to

follow

the

law,

as

only

those

convicted

of

criminal

activity

will

be

responsible

for

the

costs

and

increased

penalties.

There

are,

however,

many

concerns

with

how

this

affects

one's

First

Amendment

right

to

peaceful

assembly,

and

if

they

are

even

compliant

with

it.

Bill

could

ban

handheld

cellphone

us

while

driving

in

Minnesota

A

bipartisan

bill,

S.F.

837,

proposed

this

week

would

prohibit

the

use

of

handheld

mobile

devices

while

driving.

This

bill

is

an

effort

to

prevent

further

crashes

in

the

state

due

to

distracted

driving,

which

according

to

the

Minnesota

Office

of

Traffic

Safety,

accounts

for

one

in

four

crashes.

This

ban

would

build

upon

the

current

ban

on

texting

while

driving,

in

an

effort

to

further

dissuade

drivers

from

using

their

devices

while

driving.

If

passed,

Minnesota

would

join

14

other

states

who

ban

the

use

of

handheld

mobile

devices.

The

bill

was

referred

to

the

Senate

Transportation

Committee.

Committee

hears

bill

on

encouraging

research

and

development

This

past

week,

the

Taxes

Committee

heard

a

bill

on

increasing

tax

credits

for

research

and

development

in

Minnesota.

The

provisions

of

the

bill

allow

for

an

increase

in

the

percentage

allowed

on

research

expenses

for

the

second

tier

of

the

research

and

development

(R&D)

tax

credit.

The

bill

is

supposed

to

address

Minnesota’s

growing

strength

as

an

R&D

leader

across

the

United

States

(S.F.

417).

|