Senate

Passes

First

Bills

of

the

Session

This

week

the

Senate

passed

the

first

two

bills

of

the

2015

legislative

session,

S.F.

1,

a

bill

providing

funding

for

statewide

disaster

relief

and

S.F.

50,

a

bill

providing

for

federal

tax

conformity.

In

more

detail,

S.F.

1

provides

funding

to

match

federal

disaster

assistance

covered

by

the

Presidential

Declaration

of

Disaster

FEMA

DR-4182

covering

37

counties

and

three

tribal

governments

following

the

flooding

last

year.

The

bill

also

provides

funding

to

the

Board

of

Water

and

Soil

Resources

to

repair

damage

to

water

and

land

infrastructure

via

erosion

and

sediment

control

projects

as

well

as

funding

for

Department

of

Transportation

to

match

Federal

Highway

Administration

emergency

relief

funds

to

repair

local

roads

damaged

by

the

flooding.

The

tax

conformity

provisions

in

S.F.

50

retroactively

conforms

Minnesota's

individual

income

tax

and

corporate

franchise

tax

to

most

federal

changes

enacted

since

March

26,

2014.

The

federal

changes

to

taxable

income

affect

tax

year

2014

only.

A

significant

number

of

Minnesota

taxpayers

will

benefit

from

these

tax

relief

extenders.

An

estimated

60,000

homeowners

will

benefit

from

the

mortgage

insurance

premium

deduction;

60,000

teachers

will

benefit

from

the

continued

classroom

expense

deduction,

and

9,000

college

students

will

benefit

from

the

higher

education

tuition

deduction.

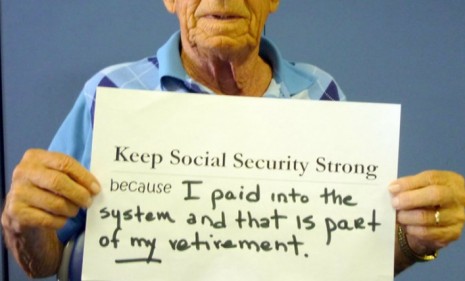

"Retire

in

Minnesota

Act"

This

week,

along

with

several

of

my

Republican

colleagues,

I

introduced

S.F.

123,

the

"Retire

in

Minnesota

Act"

which

will

gradually

phase

out

the

Minnesota

income

tax

on

social

security

income

by

10

percent

each

year

for

10

years,

at

which

time

it

will

be

completely

eliminated.

It

is

projected

the

phase

out

will

provide

upwards

of

$400

million

per

year

in

tax

relief.

Minnesota

is

one

of

only

7

states

that

still

taxes

seniors

on

their

Social

Security

income. Seniors

are

being

taxed

twice

on

their

social

security

income

–

once

when

they

pay

in

to

the

system,

and

a

second

time

when

they

receive

their

benefits

later

in

life.

After

decades

of

contribution

to

our

state

economy,

retirees

deserve

to

retire

in

their

home

state

without

being

penalized

by

double

taxation

on

their

Social

Security

benefits.

Too

many

of

our

parents

and

grandparents,

who

rely

on

social

security

income,

are

finding

it

more

and

more

difficult

just

to

get

by.

Rising

costs

for

property

taxes,

electricity

bills,

health

care,

and

groceries

are

even

forcing

some

of

them

to

get

a

part

time

job.

We're

talking

about

members

of

our

families

and

our

communities.

The

"Retire

in

Minnesota

Act"

will

make

it

easier

for

them

to

live

here,

to

stay

in

their

homes,

and

enjoy

their

retirement.

Let's

fix

this

injustice

so

our

seniors

can

enjoy

retirement

in

their

home

state

of

Minnesota.

|