Today, the US House of Representatives passed a bill that has become known as the Dodd Frank rollback as it seeks to offset much of the law that become emblematic for regulatory overreach that caused more harm than good.

The “Economic Growth, Regulatory Relief and Consumer Protection Act” (S. 2155) will now move to the White House where President Trump is expected to sign the bill into law. The vote in the House followed passage in the U.S. Senate last week where the bill captured a good amount of bipartisan support. While some critics warned that risky practices in the financial sector will re-emerge, many were quick to congratulate passage – especially the smaller banks that bore much of the Dodd Frank burden.

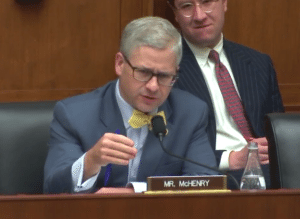

House Chief Deputy Whip Patrick McHenry released a statement on the passage saying that since Dodd Frank one in five American banks have closed and it has become harder for American families to access the financial services they need;

House Chief Deputy Whip Patrick McHenry released a statement on the passage saying that since Dodd Frank one in five American banks have closed and it has become harder for American families to access the financial services they need;

“Today, the House voted to rollback this failed law with passage of the Economic Growth, Regulatory Relief, and Consumer Protection Act. This bill is a win for consumers, making it cheaper and easier for them to save for college or borrow so they can buy a home. It includes common-sense protections such as allowing Americans the ability to freeze their credit in the case of data breaches or identity theft. This bill is good for small businesses, removing needless regulations and empowering innovative new forms of capital formation like angel investing.”

Congressman Jeb Hensarling, Chairman of the House Financial Services Committee said the bill was the most significant pro-growth financial regulatory reform package since the passage of Gramm-Leach-Bliley nearly a generation ago.

“For far too long, far too many people in our country have struggled to make ends meet. They’ve struggled to buy a car; they’ve struggled to buy a home; they’ve struggled for their version of the American Dream. Why is this happening? Because Main Street banks and credit unions that Americans depend on have been stifled by the weight, load, volume, complexity and cost of heavy Washington bureaucratic red tape which has prevented them from serving their communities. But today, that changes.”

Karen Kerrigan, President and CEO of the Small Business & Entrepreneurship Council (SBE Council), described the bill is an important measure that will help return small business lending to healthy levels.

Karen Kerrigan, President and CEO of the Small Business & Entrepreneurship Council (SBE Council), described the bill is an important measure that will help return small business lending to healthy levels.

“Access to capital remains a challenge for many entrepreneurs and small businesses. S. 2155 is a sensible bill that lifts inappropriate requirements and red tape from smaller financial institutions, which in turn will improve lending to small businesses. It is very positive to see the Congress working on a bipartisan basis to right-size regulation for our financial institutions,” said Kerrigan. “This legislation, once signed into law, will enable community banks to more effectively direct more of their resources and capital toward serving their local communities and small businesses.”

The final bill included a plethora of House legislation that was rolled up into the final language. The House Financial Services Committee provided a list of these bills:

- H.R. 2226, the “Portfolio Lending and Mortgage Access Act,” sponsored by Representative Andy Barr (R-KY).

- H.R. 2255, the “Housing Opportunities Made Easier (HOME) Act,” sponsored by Representative David Trott (R-MI).

- H.R. 2954, the “Home Mortgage Disclosure Adjustment Act,” sponsored by Representative Tom Emmer (R-MN).

- H.R. 389, the “Credit Union Residential Loan Parity Act,” sponsored by Representative Ed Royce (R-CA).

- H.R. 2948, the “S.A.F.E. Mortgage Licensing Act,” sponsored by Representative Steve Stivers (R-OH).

- H.R. 1699, the “Preserving Access to Manufactured Housing Act of 2017,” sponsored by Representative Andy Barr (R-KY).

- H.R. 3971, the “Community Institution Mortgage Relief Act of 2017,” sponsored by Representative Claudia Tenney (R-NY).

- H.R. 2403, the “Keeping Capital for Local Underserved Communities Act of 2017,” sponsored by Representative Gwen Moore (D-WI).

- H.R. 3093, the “Investor Clarity and Bank Parity Act,” sponsored by Representative Michael Capuano (D-MA).

- H.R. 4725, the “Community Bank Reporting Relief Act,” sponsored by Representative Randy Hultgren (R-IL).

- H.R. 1426, the “Federal Savings Association Charter Flexibility Act of 2017,” sponsored by Representative Keith Rothfus (R-PA).

- H.R. 4771, the “Small Bank Holding Company Relief Act of 2018,” sponsored by Representative Mia Love (R-UT).

- H.R. 5076, the “Small Bank Exam Cycle Improvement Act of 2018,” sponsored by Representative Claudia Tenney (R-NY).

- H.R. 1457, the “MOBILE Act of 2017,” sponsored by Representative Scott Tipton (R-CO).

- H.R. 2148, the “Clarifying Commercial Real Estate Loans Act,” sponsored by Representative Robert Pittenger (R-NC).

- H.R. 2683, the “Protecting Veterans Credit Act of 2017,” sponsored by Representative John Delaney (D-MD).

- H.R. 3758, the “Senior Safe Act of 2017,” sponsored by Representative Kyrsten Sinema (D-AZ).

- H.R. 4258, the “Family Self Sufficiency Act,” sponsored by Representative Sean Duffy (R-WI).

- H.R. 898, the “Credit Score Competition Act of 2017,” sponsored by Representative Ed Royce (R-CA).

- H.R. 2121, the “Pension, Endowment, and Mutual Fund Access to Banking Act,” sponsored by Representative Keith Rothfus (R-PA).

- H.R. 1624, the “Municipal Finance Support Act of 2017,” sponsored by Representative Luke Messer (R-IN).

- H.R. 4546, the “National Securities Exchange Regulatory Parity Act,” sponsored by Representative Ed Royce (R-CA).

- H.R. 1312, the “Small Business Capital Formation Enhancement Act,” sponsored by Representative Bruce Poliquin (R-ME).

- H.R. 1219, the “Supporting America’s Innovators Act of 2017,” sponsored by Representative Patrick McHenry (R-NC).

- H.R. 1257, the “Securities and Exchange Commission Overpayment Credit Act,” sponsored by Representative Gregory Meeks (D-NY).

- H.R. 1366, the “U.S. Territories Investor Protection Act of 2017,” sponsored by Representative Nydia Velazquez (D-NY).

- H.R. 1343, the “Encouraging Employee Ownership Act of 2017,” sponsored by Representative Randy Hultgren (R-IL).

- H.R. 2864, the “Improving Access to Capital Act,” sponsored by Representative Kyrsten Sinema (D-AZ).

- H.R. 4279, the “Expanding Investment Opportunities Act,” sponsored by Representative Trey Hollingsworth (R-IN).

- H.R. 3221, the “Securing Access to Affordable Mortgages Act,” sponsored by Representative David Kustoff (R-TN).

- H.R. 4790, the “Volcker Rule Regulatory Harmonization Act,” sponsored by Representative French Hill (R-AR).

- H.R. 4028, the “PROTECT Act of 2017,” sponsored by Representative Patrick McHenry (R-NC).

- H.R. 385, a bill to amend the Expedited Funds Availability Act to clarify the application of that Act to American Samoa and the Northern Mariana Islands, sponsored by Representative Aumua Amata Coleman Radewagen (R-AS).