In coordination with President Trump and our colleagues in the Senate, House Republicans have released a unified framework for bold tax reform that will deliver more jobs, fairer taxes, and bigger paychecks to the American people. As the chief tax-writing body in Congress, the Ways and Means Committee is now working to turn this framework into transformational tax reform legislation that grows our nation’s economy and improves the lives of all Americans.

Resources

More Jobs

-

Unleashes job creation with the lowest rates in modern history for American businesses of all sizes – 20% for corporations, no more than 25% for small businesses.

-

Stimulates business investment and grows paychecks by allowing businesses to fully write off purchases of new equipment needed to produce and compete at a higher level.

Fairer Taxes

-

Delivers a tax code so fair and straightforward that 9 out of 10 Americans will be able to file on a form as simple as a postcard.

-

Ends wasteful tax breaks and loopholes to focus tax relief on middle-class Americans instead of Washington special interests.

Bigger Paychecks

-

Delivers a simpler, flatter tax code with lower individual rates so families can keep more of their hard-earned income to spend, save, and invest in our local economies.

-

Doubles the standard deduction to protect more of Americans’ paychecks from taxes.

-

Moves America to a modern tax system that encourages our global businesses to bring home profits earned abroad to invest in growing jobs and paychecks in our communities.

Don’t miss out! Sign up to receive email updates as we work to fix America’s broken tax code and provide more opportunities for you and your family.

What Our Unified Tax Reform Framework Does

Lowers rates for individuals

and families

The framework shrinks the current seven tax brackets into three – 12%, 25% and 35% – with the potential for an additional top rate for the highest-income taxpayers to ensure that the wealthy do not contribute a lower share of taxes paid than they do today.

Doubles the standard deduction and enhances the child tax credit

The framework roughly doubles the standard deduction so that typical middle-class families will keep more of their paycheck. It also significantly increases the Child Tax Credit.

Creates a new lower tax rate and structure for small businesses

The framework limits the maximum tax rate for small and family-owned businesses to 25% – significantly lower than the top rate that these businesses pay today.

To create jobs and promote competitiveness, lowers the corporate tax rate

So that America can compete on level playing field, the framework reduces the corporate tax rate to 20% – below the 22.5% average of the industrialized world.

Allows unprecedented “expensing” of capital investments

The framework allows, for at least five years, businesses to immediately write off (or “expense”) the cost of new investments, giving a much-needed lift to the economy.

Moves to an American model for competitiveness

The framework ends the perverse incentive to offshore jobs and keep foreign profits overseas. It levels the playing field for American companies and workers.

Today, we have a once-in-a-generation opportunity to move forward with bold, pro-growth tax reform to create jobs, grow wages, and vault America back into the lead.

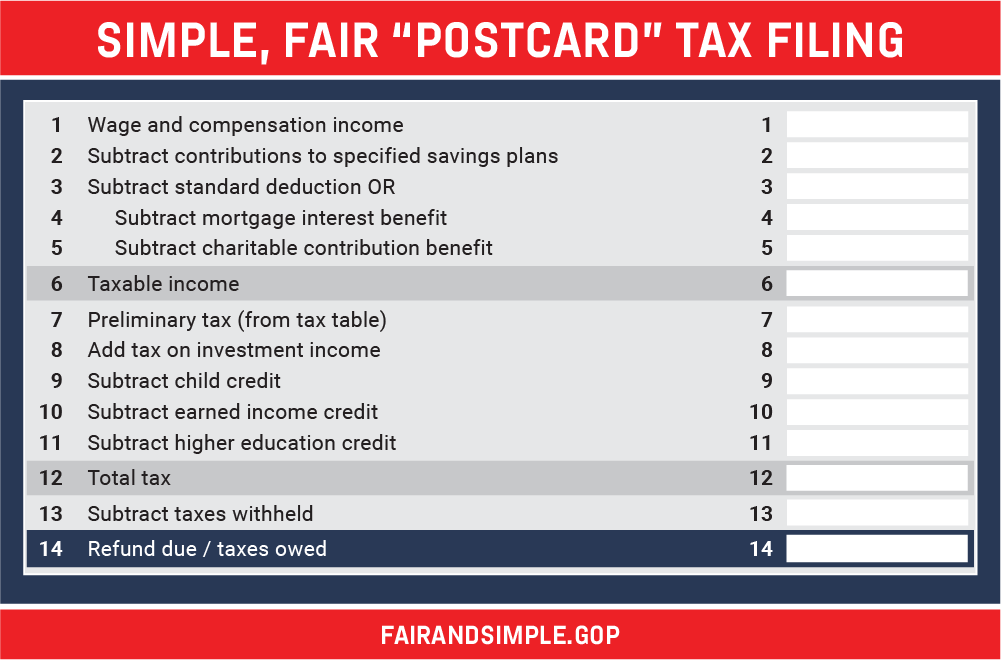

Simple, Fair “Postcard” Filing

Today, American families spend countless hours and dollars each year just to file their taxes. Under our tax reform plan, all of that will change. We take action to simplify the code so dramatically that 9 out of 10 Americans will be able to file their taxes on a form as simple as a postcard. This is achieved by:

- Eliminating the confusing maze of special interest deductions that add complexity for families and keep rates artificially high for all taxpayers

- Lowering tax rates across the board for individuals and families and reducing the number of tax brackets from seven to three

- Increasing the standard deduction so that the vast majority of taxpayers don’t have to deal with the hassle of itemizing

- Preserving and simplifying important provisions that support families, including those that help Americans buy a home, send their kids to college, and donate to their local church or charity

Our current tax code imposes the highest corporate tax rate in the industrialized world on American job creators, discourages American businesses from bringing home their foreign earnings, and favors foreign workers and businesses over American workers and business.

What They Are Saying About Pro-Growth Tax Reform

“Comprehensive tax reform represents the single greatest opportunity to remedy [our nation’s economic] shortcomings and accelerate growth in the near term and the long run.”

National Federation of Independent Business

“Tax reform has the potential to have an enormously positive impact on small businesses; it is their top priority in 2017… the U.S. economy will not reach its full potential for growth without a robust and flourishing small business sector.”

American Farm Bureau Federation

“Farm Bureau commends the Committee on Ways and Means for moving forward with comprehensive tax reform designed to spur growth of our nation’s economy. Many of the provisions of the tax reform blueprint will be beneficial to farmers, including reduced income tax rates, reduced capital gains taxes, immediate expensing for all business inputs except land, and the elimination of the estate tax.”

“Tax reform is the only way to reverse these trends and enact policies that benefit the economy. Pro-growth reform should reduce taxes on businesses to a globally competitive rate, reduce taxes on capital gains, and eliminate the death tax and gift tax.”

“Business Roundtable CEOs strongly support tax reform as the most powerful tool available to policymakers to foster greater economic growth, job creation and higher wages”

“By transforming our outdated tax code, Congress and the White House can accelerate economic growth by encouraging more business investment and boosting job growth.”

“By making America’s corporate tax rate more competitive, America will see an economic boom. We believe that only by growing the economy can we make progress on paying down our national debt, get more Americans back to work, and give the American people peace of mind that this country will be better tomorrow than it is today.”

“FreedomWorks and our community of activists hope that Congress will begin to move on fundamental tax reform in the coming weeks. After eight years of economically crippling policies, the 115th Congress has been presented with a generational moment to restore prosperity and opportunity for all Americans and achieve sustaining economic growth.”